Reliable information is verifiable, representationally faithful, and neutral. The hallmark of neutrality is its demand that accounting information not be selected to benefit one class of users to the neglect of others. While accountants recognize a tradeoff between relevance and reliability, information that lacks either of these characteristics is considered insufficient for decision making. Accounting can be classified into two categories – financial accounting and managerial accounting. Investors, lenders, and other creditors are the primary external users of accounting information. Investors may be deciding to buy shares in the company, while lenders need to analyze their risk in deciding to lend.

How confident are you in your long term financial plan?

- The remainder of this article, however, will be devoted primarily to business accounting.

- In some jurisdictions, summary financial statements are available (or may be required) on a quarterly basis.

- Financial statements are easy to generate, and you can link as many businesses to a single Wave Accounting account as you’d like.

- With unlimited users and useful inventory management features, Xero is a good pick for new entrepreneurs who are trying to get the hang of selling products and establishing a personal brand.

- Some U.S. small and mid-size enterprises (SMEs) voluntarily use IFRS accounting procedures, which are neither expressly permitted nor prohibited under applicable U.S. laws.

- Because of the simplified manner of accounting, the cash method is often used by small businesses or entities that are not required to use the accrual method of accounting.

- Still, caution should be used, as there is still leeway for number distortion under many sets of accounting principles.

Meanwhile, IFRS standards are principles-based, offering more latitude and subjectivity when interpreting guidelines. All 50 state governments prepare their financial reports according to GAAP. The Governmental Accounting Standards Board (GASB) estimates that about half of the states officially require local and county governments to adhere to GAAP.

Principles of Financial Accounting

The managerial control is achieved by analyzing in money terms the departures from the planned activities and by taking corrective measures to improve the situation in future. Financial Information should be based on facts which can easily be verified. Financial information can be verifiable if it is based on original source documents. Source documents include cash memo, purchase invoices, sales invoices, property transfer papers and written agreements, etc. Unfortunately, no objectively verifiable method has been developed for universal application. As per Robert N. Anthony, “Accounting system is a means of collecting, summarizing, analyzing and reporting, in monetary terms, information about the business”.

Generally accepted accounting principles (GAAP)

Comparing these financial statements allows stakeholders to assess a company’s financial health and understand if it can generate sustainable profits and maintain positive cash flows. This information is crucial in making sound investment and lending decisions. Proper accounting practices allow companies to maintain accuracy, efficiency, and profitability in their operations.

You need accounting to attract investors or sell your business

- The accounting-informed decisions you make can help you chart a course for positive cash flow.

- Anyone with the right skills, training, or education can take on the job.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

- These advancements help accounting professionals improve efficiency, accuracy, and collaboration, allowing them to focus on delivering value-added services to their clients.

- Accounting is a back-office function where employees may not directly interface with customers, product developers, or manufacturing.

- Simultaneously, you might decide to invest in certain aspects of your business that show the most promise.

- A balance sheet is used by management, lenders, and investors to assess the liquidity and solvency of a company.

Some business owners choose to employ in-house accountants who use accountant-friendly software to manage the business’s finances. Since accounting principles differ around the world, investors should take caution when comparing the financial statements of companies from different countries. The issue of differing accounting principles is less of a concern in more mature markets.

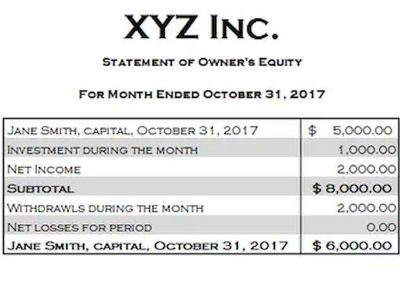

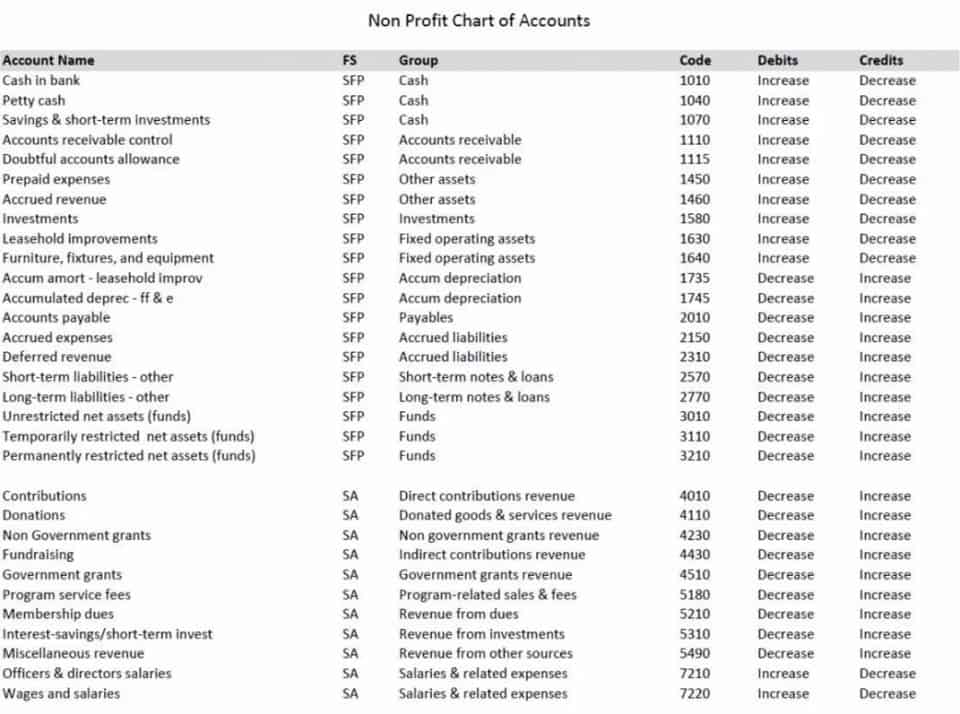

Financial accounting guidance dictates how a company records cash, values assets, and reports debt. In addition, financial statements disclose details concerning economic resources and the claims to those resources. The financial statements include the income statement, the balance sheet, the cash flow statement, and the statement of retained earnings. The standardized reporting allows all stakeholders and shareholders to assess the performance of a business. Cost accounting is often a prerequisite of managerial accounting because managers use cost accounting reports to make better business decisions.

Managerial functions

When a customer owes you money, it appears as Accounts Receivable (AR) on your balance sheet, which is generated automatically by your accounting software or manually by you or your accountant. Potential investors, stakeholders, or buyers will expect accounting records vetted by a CPA (Certified Public Accountant) that prove your business is profitable and on track for growth. While additional or subsidiary records may be kept by some businesses in terms of quantity, the basic accounting records are all kept in terms of money. Accounting is the art of recording, classifying, and summarizing transactions and events. In the first place, we maintain the records of transactions by writing various accounting books like journals and ledgers, etc. The process of tracking and interpreting financial data is known as accounting.

As technology continues to advance, it has significantly impacted the accounting profession by automating and streamlining various processes, leading to increased efficiency and accuracy. In the other example, the utility expense would have been recorded in August (the period when the invoice bookkeeping services in sacramento was paid). Even though the charges relate to services incurred in July, the cash method of financial accounting requires expenses to be recorded when they are paid, not when they occur. Another example of the accrual method of accounting are expenses that have not yet been paid.